Seamlessly Transferring Funds: A Comprehensive Guide on PayPal to Cash App Transfers

In today’s fast-paced digital economy, the ability to quickly and efficiently transfer funds between different platforms is crucial. Two of the most popular platforms for online transactions are PayPal and Cash App. While they both serve as digital wallets, they operate independently, which means direct transfers aren’t natively supported. This article delves into the various methods, both direct and indirect, that enable you to transfer funds from PayPal to Cash App.

Understanding PayPal and Cash App

Before exploring the transfer methods, let’s briefly understand each platform:

- PayPal: A global online payment system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders. It allows users to send, receive, and hold funds in various currencies.

- Cash App: A mobile payment service developed by Block, Inc. (formerly Square, Inc.), allowing users to send and receive money. It also provides features like investing in stocks and Bitcoin.

The key difference is that PayPal is more widely used for online shopping and international transactions, while Cash App is primarily designed for peer-to-peer payments and domestic use. This distinction creates a need for workarounds to move money from PayPal to Cash App.

Why Transfer from PayPal to Cash App?

There are several reasons why someone might want to transfer money from PayPal to Cash App:

- Convenience: Cash App is incredibly user-friendly, especially for mobile transactions.

- Peer-to-Peer Payments: Cash App is ideal for splitting bills, paying friends, or sending money to family.

- Investment Opportunities: Cash App allows users to invest in stocks and Bitcoin, which might not be directly available through PayPal.

- Faster Access to Funds: Some users prefer the speed and ease of withdrawing funds from Cash App compared to PayPal.

Methods to Transfer Funds from PayPal to Cash App

Unfortunately, there’s no direct, one-click method to transfer funds from PayPal to Cash App. However, several indirect methods can achieve the same result. These methods generally involve using a bank account as an intermediary.

Using a Bank Account as an Intermediary

This is the most common and reliable method. Here’s how it works:

- Link your bank account to both PayPal and Cash App:

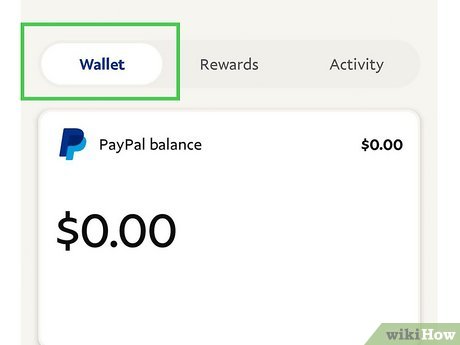

- PayPal: Go to your PayPal wallet, click ‘Link a bank’, and follow the instructions.

- Cash App: Tap the profile icon on the Cash App home screen, select ‘Linked Banks’, and follow the instructions.

- Transfer funds from PayPal to your bank account:

- Log into your PayPal account.

- Click ‘Transfer Funds’.

- Select your linked bank account.

- Enter the amount you want to transfer and confirm the transaction.

- Standard transfers usually take 1-3 business days. Instant transfers are available for a fee.

- Transfer funds from your bank account to Cash App:

- Open the Cash App.

- Tap the ‘Banking’ tab (house icon).

- Tap ‘Add Cash’.

- Enter the amount you want to add and tap ‘Add’.

- Confirm the transaction.

While this method involves multiple steps, it’s generally the safest and most straightforward way to move money from PayPal to Cash App. The processing time depends on the transfer options you choose within each platform.

Using a Debit Card as an Intermediary

Similar to the bank account method, you can also use a debit card as an intermediary:

- Link your debit card to both PayPal and Cash App:

- PayPal: Go to your PayPal wallet, click ‘Link a card’, and follow the instructions.

- Cash App: Tap the profile icon on the Cash App home screen, select ‘Linked Banks’, and follow the instructions. You can also add a debit card here.

- Withdraw funds from PayPal to your debit card:

- Log into your PayPal account.

- Click ‘Transfer Funds’.

- Select your linked debit card.

- Enter the amount you want to transfer and confirm the transaction.

- Note that fees may apply for instant transfers to debit cards.

- Add funds from your debit card to Cash App:

- Open the Cash App.

- Tap the ‘Banking’ tab (house icon).

- Tap ‘Add Cash’.

- Enter the amount you want to add and tap ‘Add’.

- Confirm the transaction.

This method can be faster than using a bank account, especially if you opt for instant transfers on PayPal. However, be mindful of the associated fees. Using a debit card to transfer from PayPal to Cash App can be a good option when speed is important.

Using a Third-Party Service (Potentially Risky)

Some third-party services claim to facilitate direct transfers between PayPal and Cash App. However, these services are often unreliable and may pose security risks. It’s crucial to exercise extreme caution when using such services. Always research the service thoroughly, read reviews, and be wary of any requests for sensitive information. The official stance is that there is no direct PayPal to Cash App transfer, so use these at your own risk.

Disclaimer: We strongly advise against using unofficial third-party services due to the potential for fraud and security breaches. Sticking to the bank account or debit card method is the safest approach.

Factors to Consider Before Transferring

Before initiating a transfer from PayPal to Cash App, consider the following factors:

- Fees: PayPal and Cash App may charge fees for certain types of transfers, especially instant transfers. Check the fee structures on both platforms before proceeding.

- Transfer Limits: Both platforms have daily, weekly, and monthly transfer limits. Ensure that your transfer amount falls within these limits.

- Processing Time: Standard transfers can take 1-3 business days, while instant transfers are usually processed within minutes. Choose the option that best suits your needs and timeline.

- Security: Always use strong passwords and enable two-factor authentication on both PayPal and Cash App to protect your account from unauthorized access.

Troubleshooting Common Issues

Here are some common issues you might encounter and how to troubleshoot them:

- Bank account or debit card not linking: Double-check that the information you entered is correct. Contact your bank or card issuer if the problem persists.

- Transfer delays: Standard transfers can take up to 3 business days. If your transfer is delayed beyond this timeframe, contact PayPal or Cash App support.

- Transfer failures: This could be due to insufficient funds, incorrect account information, or transfer limits. Verify all details and try again.

Alternatives to Transferring from PayPal to Cash App

If transferring from PayPal to Cash App proves too cumbersome, consider these alternatives:

- Using a different payment app: Explore other payment apps that might offer more seamless integration or features that better suit your needs.

- Requesting payment via Cash App: Instead of transferring funds, ask the person paying you to send the money directly to your Cash App account.

- Spending directly from PayPal: If you need to make a purchase, consider using your PayPal balance directly instead of transferring it to Cash App.

The Future of Digital Transfers

The landscape of digital transfers is constantly evolving. As technology advances, we can expect to see more seamless and integrated payment solutions. Ideally, future platforms will eliminate the need for cumbersome workarounds and allow for direct transfers between different digital wallets. For now, understanding the available methods and their limitations is crucial for navigating the current system and effectively transferring funds from PayPal to Cash App.

Conclusion

While a direct PayPal to Cash App transfer isn’t possible, utilizing a bank account or debit card as an intermediary provides a reliable solution. Remember to consider fees, transfer limits, and security measures before initiating any transaction. Stay informed about the evolving landscape of digital payments to make the most efficient and secure choices for your financial needs. By understanding these methods, you can effectively manage your funds across both platforms and leverage the unique benefits each offers. Always prioritize security and be cautious of unofficial third-party services promising direct transfers. Stick to established methods to ensure the safety of your funds and personal information. Keep in mind that the best option depends on your individual needs and circumstances, so weigh the pros and cons of each method carefully before making a decision. This guide provides a comprehensive overview to help you navigate the process and make informed choices when transferring funds from PayPal to Cash App.

[See also: Understanding Digital Wallets and Their Security Features]

[See also: Comparing PayPal and Cash App: Which is Right for You?]