Can You Connect a Credit Card to Cash App? A Comprehensive Guide

Cash App has revolutionized the way we handle peer-to-peer transactions, allowing users to send and receive money with ease. A common question among new and seasoned users alike is: Can you connect a credit card to Cash App? The short answer is yes, but there are some important considerations to keep in mind. This article will delve into the specifics of linking a credit card to Cash App, the associated fees, potential benefits, and alternative payment methods.

Understanding Cash App and its Payment Options

Cash App, developed by Block, Inc. (formerly Square, Inc.), is a mobile payment service that allows users to transfer money to one another using a mobile app. It’s widely used for splitting bills, paying for services, or sending gifts. To facilitate these transactions, Cash App supports various funding sources.

- Debit Cards: Linking a debit card is the most common and often the most cost-effective way to fund Cash App transactions.

- Bank Accounts: You can also link your bank account directly to Cash App for seamless transfers.

- Credit Cards: As mentioned, you can connect a credit card to Cash App, but there are some caveats.

- Cash App Balance: Funds received through Cash App can be used for future transactions.

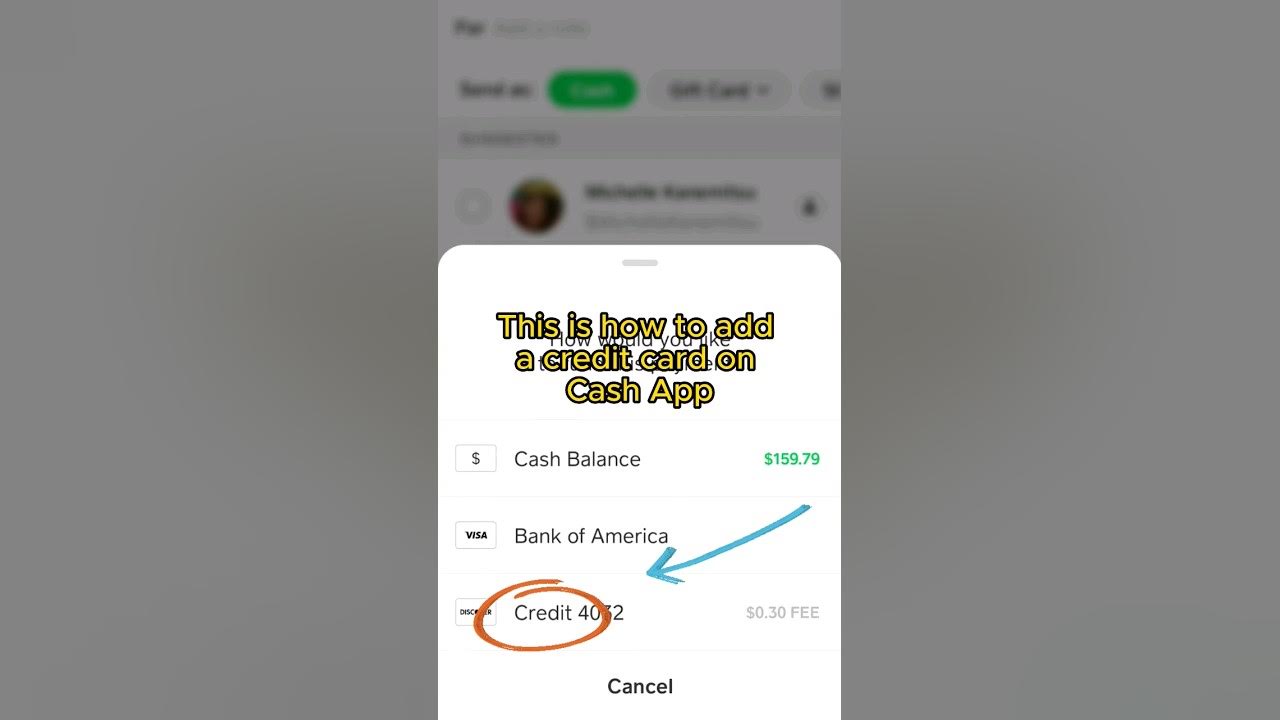

The Process of Connecting a Credit Card to Cash App

Adding a credit card to your Cash App account is a straightforward process. Here’s a step-by-step guide:

- Open Cash App: Launch the Cash App application on your smartphone.

- Tap the Profile Icon: Locate and tap the profile icon, usually found in the upper-right corner of the screen.

- Select “Linked Banks”: Scroll down the menu and select the “Linked Banks” option.

- Add a Bank or Card: Choose the “Add Bank or Card” option.

- Select “Add Credit Card”: Opt for the “Add Credit Card” option.

- Enter Card Details: Carefully enter your credit card number, expiration date, CVV code, and billing zip code.

- Verification: Cash App may require you to verify your card details through a security code or other authentication method.

Once the process is complete, your credit card will be linked to your Cash App account. You can then use it to send payments to other users.

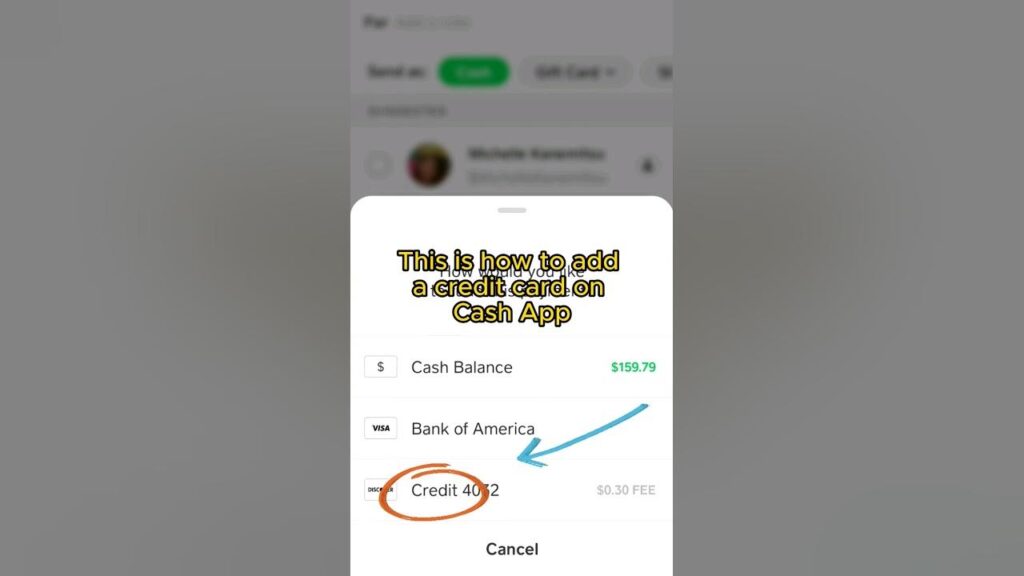

Fees Associated with Using a Credit Card on Cash App

One of the most important factors to consider when deciding whether to connect a credit card to Cash App is the associated fees. Unlike debit card transactions, which are typically free, using a credit card to send money on Cash App incurs a fee. This fee is generally around 3% of the transaction amount.

For example, if you send $100 to a friend using your credit card on Cash App, you will be charged $3 in fees, resulting in a total charge of $103. These fees are designed to cover the costs associated with processing credit card transactions and are standard practice in the industry.

Why Does Cash App Charge a Fee for Credit Card Transactions?

The fees associated with credit card transactions on Cash App are primarily due to the interchange fees charged by credit card networks like Visa, Mastercard, American Express, and Discover. These fees are charged to merchants (in this case, Cash App) for processing credit card payments. Cash App passes a portion of these fees onto the user to cover their costs.

Debit card transactions, on the other hand, typically have lower interchange fees, which is why Cash App can offer them for free. The difference in fees reflects the inherent costs associated with each type of payment method.

Benefits of Connecting a Credit Card to Cash App

Despite the fees, there are several potential benefits to connecting a credit card to Cash App:

- Convenience: Using a credit card can be more convenient than transferring funds from your bank account, especially if you don’t have sufficient funds in your Cash App balance or debit card.

- Rewards and Points: If your credit card offers rewards points, cashback, or other perks, you can earn these benefits by using your card on Cash App. This can help offset the transaction fees, making it a worthwhile option for some users.

- Building Credit: Using a credit card responsibly and paying off your balance on time can help you build a positive credit history. Using Cash App with a credit card can be a small part of this process.

- Emergency Situations: In situations where you need to send money quickly but don’t have immediate access to funds in your bank account or debit card, using a credit card can be a lifesaver.

Alternatives to Using a Credit Card on Cash App

If you’re looking to avoid the 3% fee associated with credit card transactions, there are several alternative payment methods you can use on Cash App:

- Debit Card: Linking a debit card is the most common and cost-effective option. Transactions are typically free, and you can easily transfer funds from your bank account to your Cash App balance.

- Bank Account: You can also link your bank account directly to Cash App. This allows you to send and receive money without using a card. However, transfers from your bank account may take a few business days to process.

- Cash App Balance: If you have funds in your Cash App balance, you can use them to send payments without incurring any fees. You can add funds to your Cash App balance by receiving payments from other users or by transferring money from your linked bank account or debit card.

Security Considerations When Using Credit Cards on Cash App

When you connect a credit card to Cash App, it’s crucial to be aware of security considerations to protect your financial information:

- Use Strong Passwords: Ensure your Cash App account has a strong, unique password that is not used for any other online accounts.

- Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security to your account by requiring a verification code from your phone or email in addition to your password.

- Monitor Transactions: Regularly review your Cash App transaction history and credit card statements for any unauthorized activity.

- Be Wary of Scams: Be cautious of scams and phishing attempts. Never share your Cash App login credentials or credit card information with anyone.

- Keep Your App Updated: Ensure your Cash App application is always updated to the latest version to benefit from the latest security patches and features.

Troubleshooting Common Issues

Sometimes, users may encounter issues when trying to connect a credit card to Cash App. Here are some common problems and troubleshooting tips:

- Incorrect Card Details: Double-check that you have entered your credit card number, expiration date, CVV code, and billing zip code correctly.

- Card Not Supported: Cash App may not support certain types of credit cards. Contact Cash App support to confirm if your card is compatible.

- Insufficient Funds: Ensure your credit card has sufficient available credit to cover the transaction amount and any associated fees.

- Security Block: Your credit card issuer may have blocked the transaction due to security concerns. Contact your credit card company to verify and remove the block.

- Cash App Restrictions: Cash App may have restrictions on your account that prevent you from linking a credit card. Contact Cash App support for assistance.

Cash App’s Credit Card Limits and Verification

Cash App implements certain limits and verification processes to ensure the security and integrity of transactions. These measures can affect how you connect a credit card to Cash App and the extent to which you can use it.

- Spending Limits: Cash App has spending limits for unverified accounts. To increase these limits, you may need to verify your identity by providing additional information, such as your full name, date of birth, and social security number.

- Verification Process: The verification process typically involves submitting a photo of your driver’s license or other government-issued ID. Cash App uses this information to confirm your identity and prevent fraud.

- Transaction Limits: Even after verification, Cash App may impose transaction limits on credit card payments to protect against unauthorized use. These limits can vary depending on your account activity and risk profile.

Future Developments in Cash App Payment Options

Cash App is constantly evolving, and it’s likely that there will be future developments in its payment options. These developments could include new ways to connect a credit card to Cash App, lower fees, or additional security features. Staying informed about these changes can help you make the most of the platform.

For example, Cash App may introduce partnerships with credit card companies to offer exclusive rewards or discounts for using certain cards on the platform. They may also explore alternative fee structures that are more transparent and predictable.

Conclusion: Making an Informed Decision

In conclusion, you can connect a credit card to Cash App, but it’s important to understand the associated fees and potential benefits. While using a credit card offers convenience and the opportunity to earn rewards, it also comes with a 3% transaction fee. Consider alternative payment methods, such as debit cards or your Cash App balance, to avoid these fees.

Ultimately, the decision of whether to connect a credit card to Cash App depends on your individual circumstances and preferences. Weigh the pros and cons carefully, and choose the payment method that best suits your needs. By being informed and proactive, you can make the most of Cash App’s features while minimizing costs and risks. [See also: Cash App vs Venmo: Which is Better?] and [See also: How to Increase Your Cash App Limit]